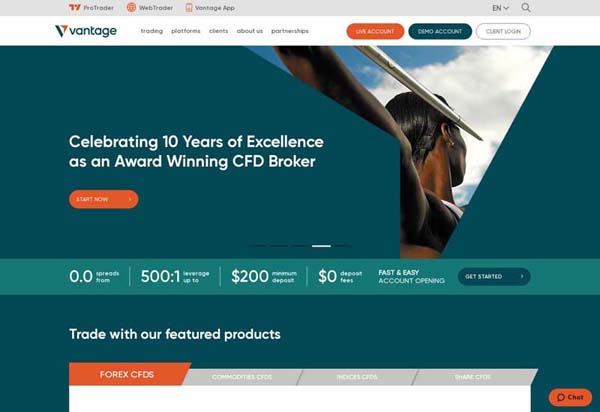

Vantage FX is a trading platform founded in 2008. Vantage FX offers trading financial instruments to its 10,000 customers.

Vantage FX is regulated by Australian Securities and Investment Commission (ASIC), Cayman Islands Monetary Authority (CIMA), Financial Conduct Authority (FCA), Vanuatu Financial Services Commission (VFSC)

| Year Founded | 2008 |

| Registered Users | 10000 |

| Livechat | No |

| What You Can Trade | Forex, Commodities, Indices, Stocks, Crypto, Futures, CFDs |

| Payment Methods | BPAY, JCB Card, POLi, Skrill |

| Trading fees | No |

| Inactivity fee | No |

| Withdrawal fees | No |

| Min deposit | 200 |

| Account Opening | 1 day |

| Electric Wallets | No |

| Base currencies | 9 |

| Demo account | Yes |

| Regulation | Australian Securities and Investment Commission (ASIC), Cayman Islands Monetary Authority (CIMA), Financial Conduct Authority (FCA), Vanuatu Financial Services Commission (VFSC) |

Vantage FX is a platform that offers web and mobile services and lets users invest in and trade Forex trading, CFD trading, Spread Betting, Social trading, Share Dealing all in one place. Here is a list of the types of assets you can trade on Vantage FX:

Risk Warning: Your capital is at risk.

Vantage FX does not offer stock trading.

Stockbrokers act as a link between markets (such as exchanges) and the general public. Customers place orders with brokers, and brokers endeavour to fill them as cheaply as feasible. They are compensated with a fee known as a commission. As online brokerage systems allow consumers to enter their own orders via the web or mobile app, many stockbrokers have converted to financial counsellors or planners.

Vantage FX supports trading cryptocurrencies.

The cryptocurrencies Vantage FX supports include BTC.

A cryptocurrency exchange is a website where you may buy and sell digital currencies. You can use exchanges to convert one cryptocurrency to another, such as Bitcoin to Ethereum, or to purchase cryptocurrency with fiat currency, such as the US dollar. The pricing of the cryptocurrencies on exchanges are based on current market prices.

Vantage FX supports Forex Trading on over Forex currency pairs.

A forex broker, is a financial institution that allows you to purchase and sell currencies. It functions as an intermediary between merchants and the interbank market, which is a global market where foreign currency can be traded. A forex broker would traditionally buy and sell currencies on your behalf.

Vantage FX supports CFD trading.

Vantage FX allows trading in CFD stocks and shares. Vantage FX allows trading in CFDs on stock indexes. Vantage FX supports commodity CFDs.CFD trading is a high risk trading method using leverage from a CFD broker to speculate on the price movements of assets such as stocks, forex, commodities and even cryptocurrencies. A Contract for Difference (CFD) is an agreement between an investor and a CFD broker to pay the difference between an asset's opening and closing prices, such as a UK stock. No underlying assets are exchanged on a CFD trade, it is purely a speculative deal on the up or down price movement on an aggreed financial asset between the trader and CFD broker.

Vantage FX does not ETF trading.

ETFs (Exchanged-Traded Funds) are one of the most rapidly developing segments of the financial markets. They are popular among investors because they are inexpensive and transparent, and they provide easy coverage. Because of their high liquidity, even sophisticated hedge funds trade ETFs. ETFs are purchased and sold in the same way as normal stocks are, so you'll need to pick an online broker before you can invest.

Vantage FX does not offers the Metatrader 4 (MT4) trading platform.

MetaTrader4 (MT4) is a popular internet trading platform for automating your trading. Its user-friendly interface allows you to access extensive technical analysis and trading algorithms. MT4 was released in 2005. MetaTrader 4 can be used to trade a variety of markets via CFDs, including forex, indices, cryptocurrencies, and commodities, however it is most usually linked with FX trading.

Vantage FX does not offers the Metatrader 5 (MT5) trading platform.

MetaTrader 5 is a multi-asset trading platform that supports Forex, stocks, and futures trading. It has advanced capabilities for price analysis, algorithmic trading (trading robots, Expert Advisors), and copy trading.

It's a great platform for experienced traders because it has a lot of analysis tools and indicators. Expert advisors and signals can also be used to automate trading. MT4 is a CFD forex trading platform, whereas MT5 is a multi-asset trading platform that covers both centralised and non-centralised financial markets, including stocks, futures, and FX trading instruments. MT5 is more efficient and speedier than MT4.

Vantage FX does not offers the cTrader trading platform.

cTrader is a full-featured trading platform that Forex and CFD firms can provide to their clients. The platform is jam-packed with features that cater to every type of investment preference imaginable.

In 2011, cTrader was released at the same time as MT5. cTrader, like MT5, has more advanced trading tools and indicators. Unlike MetaTrader systems, however, cTrader makes use of the more widely used C# programming language. cTrader's design is more current, and it includes a dot chart as an additional chart type.

Vantage FX allows traders to use copytrading and social trading features as part of their trading strategies.

Copy trading is a portfolio management approach in which one tracks the performance of another trader by copying his or her moves. There is also an automated variant of copy trading, in which all of one's trades are executed automatically. A trader can perform their own deals in a manual version.

For novice and new traders, copy trading is a fantastic solution. You have the option of starting slowly and learning how to trade properly. This means that you can study while also earning if you are new to Forex trading.

Everyone can participate in social trading and investment. Traders can emulate more experienced investors who share their trading information using social platforms (and brokers). Retail traders can monitor what professional traders are doing throughout the social trading platform and place trades using their broker's platform or app.

Vantage FX offers Islamic accounts that are compliant with Shariar law.

An Islamic broker account is a halal trading account available to clients who revere the Quran and seek to invest in the Islamic stock market using Islamic finance principles. Traders with Islamic accounts do not pay or earn interest rates since Sharia law prohibits the accrual of interest.

A minimum investment of 200 is required when trading financial instruments with Vantage FX.

Users have the option of trading in pounds, euros, or dollars. All accounts allow users to trade in pounds, euros, and dollars.

Vantage FX further claims that all withdrawal requests will be processed within two business days, and that this may be done both on the app and on the website.

In the world of stock investing it is not uncommon for a platform to offer new users, or users of certain categories, a free stock for joining the platform. Vantage FX often affords users a free stock for simply opening an account with them, but at other times requires users to take certain actions, such as making a minimum deposit or actually making a trade.

The caliber and reputation of Vantage FX can be evaluated on the features that it offers its users. Some of its key features include order execution tools, live news feeds, fundamental research tools, scanning tools, charts, and live support from Vantage FX staff. Alternatively, one can analyse the trading features themselves that Vantage FX might have to offer. These may include low minimum investment, zero commission investing, fractional shares, no foreign exchange fees, unlimited instant trades, tutorials, and a practice portfolio for newcomers to get used to trading with.

With Vantage FX, there is the opportunity for certain experienced users to upgrade to a pro trading account. The accessibility of such an account will depend on the average number of CFD trades completed, the size of one's investment portfolio, or a proven knowledge of how CFD trading works. Although upgrading to a Vantage FX pro account may waive some features that provide protection for retail users and also charge commission per transaction, it does offer significantly lower spreads than a standard account.

In general, there are two forms of stock research: fundamental analysis and technical analysis. Fundamental analysis involves judging the fair value of a company by looking at debt levels, price-to-earnings ratios, and cash flow. This can help one decide if a stock is valued at a fair price. Technical analysis, on the other hand, is based more on chart patterns. One can utilise indicators such as moving averages, Fibonacci lines, and trading volumes to predict where a price is next heading. Fundamental analysis is typically more suitable for long-term investors. Take a look at the fundamental and technical tools that Vantage FX has to offer. Find out if you can pull up charts on any available company and edit/alter the platforms chart tools and indicators to help gauge whether the price of a stock is going up or down. Vantage FX also provides a newsfeed of economic data with analyses in order to help investors predict where the markets might move or how they will react to a world event. If you are a beginner trader, Vantage FX can also provide video tutorials so that one can learn about investing as they go along. Such videos are usually clear, succinct, and under 10 minutes.

Trading ideas are investment ideas which are sent by Vantage FX to their customers. They usually propose a trade for a specific stock and are developed by an author’s own knowledge of a customer's specific type of investment interest. Vantage FX can take into account a customer's investment style, sector focus, or portfolio size. Users of Vantage FX are able to take advantage of daily trading ideas and the Vantage FX charting tools. These also include over 60 technical indicators: a truly comprehensive offering.

On Vantage FX traders can utilise fundamental data analysis to perform stock evaluation related to current economic environments, a company's competitors, and a company's financial health. Traders can use the data they find on Vantage FX to determine a stock's intrinsic value.

Vantage FX offers traders the ability to use charting tools with over 60 technical indicators. Many traders use the chart patterns available on Vantage FX alongside news events in order to help determine when to buy and sell stock or share.

Vantage FX has a newsfeed feature too, which displays economic data and analyses of current news events to help users predict how the markets might react to such events. Vantage FX offers comprehensive research-backed analysis on financial markets and investments from the top analysts, and it allows for users of the platform to set price alerts and notifications about entities such as executed orders or margin calls. Having a news feed means that such features can be executed as soon as big events across the world occur.

A Vantage FX market order is an order to buy or sell a stock at a market's best available price in that current moment. A market order will usually complete an execution, but it does not guarantee a specified price. Market orders are at their best use when the primary goal of a trader is to execute their trade immediately.

A Vantage FX stop-limit order is an order to buy or sell a stock combining the features of a stop order and a limit order. Once the stop price of a trade is reached, a stop-limit becomes a limit order that will then be executed at a pre-determined price.

A Vantage FX stop order is an order that a trader places to buy or sell a stock once the price of that stock reaches a pre-determined price, known as the 'stop price'. When this specific stop price is reached, a stop order will then become a market order.

A Vantage FX limit order is an order placed by a trader to buy or sell a specific stock but with a certain restriction on the maximum price that will be paid for the stock or the minimum price that will be received after the stock is sold. If the order is filled on Vantage FX, it will be at the pre-determined limit price or better only. Having said this, with a Vantage FX limit order there is no assurance of trade execution.

There are several ways in which one can fund their Vantage FX account. Funding can be enacted via a number of means, including debit or credit cards, Google Pay, Apple Pay, or Skrill. These options are free until a certain deposit limit has been reached: once over that limit, there may be a small fee applied. There is a way for users to deposit funds on Vantage FX without having any fees attached, which is by using traditional bank transfer. This feature does also depend on what account type you are depositing in to.

Vantage FX prioritises use of new technology to make the trading process faster, more comfortable, and more accessible. With active trading on Vantage FX, users have access to the foreign exchange and other markets. There is also a comprehensive variety of asset classes from which one can gain access on Vantage FX, which includes Forex trading, CFD trading, Spread Betting, Social trading, Share Dealing depending on the Vantage FX account type one chooses.

Vantage FX web trading is the process through which traders can open and close positions online without downloading software. Using a web browser, investors and trading can follow bid-ask spreads, place take profit orders, or place stop loss orders, and track any positions that have been executed.

Vantage FX is regulated by the Financial Conduct Authority, meaning that it must always take the relevant steps to ensure its users' money is safe. Vantage FX also possesses a range of security measures designed to seek out any system bugs and therefore protect its users.

Vantage FX offers users a built-in tab to monitor one's portfolio and to search for specific stocks. By doing so you are able to view a company's share price and financial details, such as revenues, price earnings, and price to earnings ratio. One of the most notable features of Vantage FX is its customisability and search functions.

Look at if Vantage FX lets you place orders with zero commission. Before you place a trade on Vantage FX, you will be shown a review of your order with a brief time limit within which to accept the order and allow it to go through. Another feature that is very useful on Vantage FX is the ability place trades in several ways and execute a variety of manoeuvres on a trading pair simultaneously.

Vantage FX also offers useful functions such as alerts and notifications as well as portfolio and fee reports in order to help access your trade results. Areas of the Vantage FX app and afford users the opportunity of setting price alerts. Traders on Vantage FX are able to set price alerts and notifications for indicators such as executed orders, margin calls, or important world news that might affect the trading market. Look at whether the Vantage FX app allows you to set price alerts. These can be crucial as they allow one to receive push notifications when a specific position hits a certain price. This means you are able to move in or out of a stock without needs to be constantly watching market movements at your desk.

Portfolio and fee reports on Vantage FX provide users with access to their trading results, the interest charged on trades or the interest earned on them, and other key bits of information that will help make your trades successful. Take a look at whether Vantage FX offers an economic calendar too, as they can offer useful economic reports with expected impact on your personal trades.

Vantage FX offers a iPhone Apple iOS mobile trading app available on iTunes.

Vantage FX offers an Android mobile trading app available on the Google Play store.

Vantage FX mobile trading is where traders can use wireless technology for securities trading and via their smartphones. Using the Vantage FX mobile trading software is a great way for both novice and more experienced traders to invest their money on the go. Vantage FX mobile trading can offer a more clean and modern interface compared to the web-based platform. Simple swipes help switch between the variety of functions and areas of the Vantage FX app and there is the capability of setting price alerts and accessing training videos or forums.

Vantage FX desktop trading involves trading via the platform on a desktop application that can be downloaded from the Internet. There may even be a desktop version that is browser-based so no downloads will be required, however Vantage FX may offer a browser extension to make easier the process of trading.

Vantage FX trading fees primarily consist of the mark-up between the bid and ask price, which is known as the spread. Spreads can vary depending on the asset one buys and can either be variable, dictated by supple and demand, or a fixed one. The biggest Vantage FX trading fee comes from swap rates on leveraged overnight positions. Most are negative swap rates, but some assets carry a positive one, where traders are in fact paid to hold a position. Further Vantage FX fees to consider include an inactivity fee, which is where a fee is charged if no trading activity occurs for a certain number of consecutive days. A withdrawal fee for bank transfers can also apply, and third-party levies from payment processors need to be kept in mind.

A commission is a fee that is paid in exchange for an exchange facilitating or completing a trade. Check whether Vantage FX charges this as some exchanges offer zero commission trading. This is the percentage or fixed payment associated with a certain amount of sale.

Stocks and ETFs are traded directly on an exchange meaning that they may be subject to brokerage commissions, which can vary depending on the exchange. Look at whether Vantage FX requires such a trading fee.

CFD providers typically charge a financing rate for holding a trader's position overnight. This can be as high as the LIBOR rate plus or minus 3%.

Forex fees are calculated by subtracting the bid price of a trade from the ask price in order to find the spread. The exchange then keeps the spread as a fee or commission, so check whether Vantage FX requires such a fee.

Non-trading fees can include various fees or charges that one has to pay which are not related to buying or selling assets on an exchange. Common non-trading fees include the withdrawal fee, deposit fee, account fee, or inactivity fee.

Opening an account with Vantage FX is very quick and simple. You need to check that the account you open with Vantage FX is covered by a major financial regulator that offers you protection in your country.

Follow the below steps to open your Vantage FX account;

Vantage FX have a minium deposit requirement of 200 before trading.

Withdrawing and depositing to your trading account is one of the most important aspects to the trading aspects to trading. Vantage FX must be relied upon when deposited too and withdrawing from the Vantage FX platform.

Vantage FX does not offer any additional base currencies.

Vantage FX does charge a deposit fee.

Vantage FX does not charge withdrawal fees.

Vantage FX are regulated by Australian Securities and Investment Commission (ASIC), Cayman Islands Monetary Authority (CIMA), Financial Conduct Authority (FCA), Vanuatu Financial Services Commission (VFSC).

Vantage FX offers users comprehensive support via email,phone, and live chat.

Vantage FX have shown consistent levels of good service as well as fast response times with informative and relevant replies. One of the key points about Vantage FX customer service is that it is available 24/7 and in a variety of different languages.

Vantage FX offers a variety of education resources for both beginner and seasoned traders. This includes detailed economic calendars and technical analysis, as well as tutorials on trading in all its facets. Vantage FX also offers a variety of research-backed analyses tools with regards to the financial markets and investments from top analysts and traders. Users are also able to set price alerts and notifications for executed orders, margin calls, or important news events.

Vantage FX earns a commission from customers on CFD trades. Vantage FX also earn money from spreads.

The spread of financial instrument prices is how brokers like Vantage FX make money. The difference between the purchasing and selling price of a financial item is known as a spread in trading. Deposit fees, withdrawal fees, inactivity fees, and overnight costs are all possible sources of revenue for brokers like Vantage FX. CFD leverage trading generates money for a number of brokers. CFD trading is a high-risk speculative deal between a broker and a trader based on the price movement of a certain financial asset up or down. A CFD does not involve the exchange of any underlying assets; instead, it is completely based on price movement speculation.

If Vantage FX isn’t quite what you are looking for you can check out some of the best Vantage FX alternatives below.

If you would like to see Vantage FX compared against some of the best Vantage FX alternatives available right now you can do so by clicking on the links below.