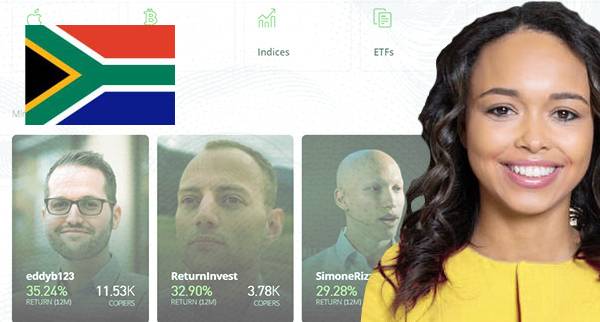

There are many websites offering copy-trading services to South Africa traders. eToro is the worlds largest copy trading platform and offers more than 1 million users in over 140 countries including South Africa. eToro is not the only copy trading platform out there we describe the best South Africa copy trading platforms in more detail further below this guide. South Africa copy trading platforms offer financial instruments across major asset classes including currency pairs traded on a range of major global exchanges around the world as well as indices and commodities.

South Africa a platform where they can copy trade CFDs on currencies, commodities and indices via their social network which allows users to follow each other’s investment strategy and potentially profit from them.

South Africa copy trading platforms offer daily market news updates from top financial publications like The Wall Street Journal an Forbes magazine among others through an online portal called MarketWatch which give traders access to vital information needed for making sound investment decisions about investments such as forex or stocks.

🤴 IC Markets is Used By: 180,000

⚡ IC Markets is Regulated by: Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA), Cyprus Securities and Exchange Commission (CySEC)

💵 What You Can Trade with IC Markets: Forex, Majors, Energies, Metals, Agriculturals,

💵 Instruments Available with IC Markets: 232

📈 IC Markets Inactivity Fees: No

💰 IC Markets Withdrawal Fees: No

💰 IC Markets Payment Methods: Credit Cards, VISA, MasterCard, Debit Cards, Visa, MasterCard, Bank Transfer, PayPal, Neteller, Neteller VIP, Skrill, Poli, Cheque, BPAY, UnionPay, FasaPay, QIWI, RapidPay, Klarna, Electronic wallets (eWallets), Broker to Brokers, Thai Internet Banking, Vietnamese Internet Banking,

IC Markets Risk warning : Losses can exceed deposits

🤴 Roboforex is Used By: 10,000

⚡ Roboforex is Regulated by: RoboForex Lid is regulated by Belize FSC, License No. 000138/7, reg. number 000001272

💵 What You Can Trade with Roboforex: Forex, Minors, Majors, Exotics, Indices, Metals,

💵 Instruments Available with Roboforex: 100

📈 Roboforex Inactivity Fees: No

💰 Roboforex Withdrawal Fees: Yes

💰 Roboforex Payment Methods: Credit cards, VISA, MasterCard, JCB, Debit cards, Bank Transfer, Electronic wallets (eWallets), Neteller, Skrill, Perfect Money, AdvCash, BPAY, China UnionPay, FasaPay, CashU, WeChat Pay, ecoPayZ, AstroPay, Sofort, Giropay, Poli, Wepay, iDEAL, Payoneer,

Roboforex Risk warning : Losses can exceed deposits

🤴 AvaTrade is Used By: 200,000

⚡ AvaTrade is Regulated by: Central Bank of Ireland, Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA), South African Financial Sector Conduct Authority (FSCA), Financial Stability Board (FSB), Abu Dhabi Global Markets (ADGM), Financial Regulatory Services Authority (FRSA), British Virgin Islands Financial Services Commission (BVI)

💵 What You Can Trade with AvaTrade: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, UK Stocks, US Stocks, Energies, Metals, Agriculturals, ETFs, IPO, Bonds,

💵 Instruments Available with AvaTrade: 1000

📈 AvaTrade Inactivity Fees: No

💰 AvaTrade Withdrawal Fees: No

💰 AvaTrade Payment Methods: Credit cards, VISA, MasterCard, Bank Transfer, Electronic wallets (eWallets), PayPal, Neteller, WebMoney, Payoneer,

AvaTrade Risk warning : 71% of retail CFD accounts lose money

🤴 FP Markets is Used By: 10,000

⚡ FP Markets is Regulated by: Australian Securities and Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), Financial Services Authority (St. Vincent and the Grenadines)

💵 What You Can Trade with FP Markets: Forex, Minors, Majors, Exotics, Indices, Metals,

💵 Instruments Available with FP Markets: 100

📈 FP Markets Inactivity Fees: No

💰 FP Markets Withdrawal Fees: No

💰 FP Markets Payment Methods: Credit cards, VISA, MasterCard, Debit cards, Bank Transfer, Electronic wallets (eWallets), Neteller, BPAY, POLi, PayPal, Neteller, Skrill, PayTrust, NganLuong VN, Fasapay, Broker to Broker, OnlinePay China, Directa24, Klarna, PayTrust88, Payoneer,

FP Markets Risk warning : Losses can exceed deposits

🤴 NordFX is Used By: 10,000

⚡ NordFX is Regulated by: Cyprus Securities and Exchange Commission (CySEC), License No: 209/13

💵 What You Can Trade with NordFX: Forex, Majors, Metals,

💵 Instruments Available with NordFX: 50

📈 NordFX Inactivity Fees: No

💰 NordFX Withdrawal Fees: No

💰 NordFX Payment Methods: Bank Transfer, Neteller, PerfectMoney, WebMoney, FasaPay, CashU, Payza, QIWI,

NordFX Risk warning : Losses can exceed deposits

🤴 XTB is Used By: 250,000

⚡ XTB is Regulated by: Financial Conduct Authority (FCA), FCA number FRN 522157, Cyprus Securities and Exchange Commission (CySEC), CySEC Licence Number: 169/12, Comision Nacional del Mercado de Valores, Komisja Nadzoru Finansowego, Belize International Financial Services Commission (IFSC) under license number IFSC/60/413/TS/19, Polish Securities and Exchange Commission (KPWiG), Dubai Financial Services Authority (DFSA), Dubai International Financial Center (DIFC),Financial Sector Conduct Authority (FSCA), XTB AFRICA (PTY) LTD licensed to operate in South Africa

💵 What You Can Trade with XTB: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, UK Stocks, US Stocks, Pennystocks, Energies, Metals, Agriculturals, ETFs,

💵 Instruments Available with XTB: 4000

📈 XTB Inactivity Fees: Yes

💰 XTB Withdrawal Fees: No

💰 XTB Payment Methods: Credit cards, MasterCard, Maestro, Visa, Debit cards, Bank Transfer, Electronic wallets (eWallets), PayPal, Neteller, Skrill, Poli, Paysafe, Payoneer,

XTB Risk warning : 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

🤴 Pepperstone is Used By: 89,000

⚡ Pepperstone is Regulated by: Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), Federal Financial Supervisory Authority (BaFin), Dubai Financial Services Authority (DFSA), Capital Markets Authority of Kenya (CMA), Pepperstone Markets Limited is incorporated in The Bahamas (number 177174 B), Licensed by the Securities Commission of the Bahamas (SCB) number SIA-F217

💵 What You Can Trade with Pepperstone: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, Energies, Metals,

💵 Instruments Available with Pepperstone: 100

📈 Pepperstone Inactivity Fees: Yes

💰 Pepperstone Withdrawal Fees: No

💰 Pepperstone Payment Methods: Credit cards, VISA, MasterCard, Debit cards, Bank Transfer, Electronic wallets (eWallets), PayPal, Neteller, BPAY, POLi, UnionPay, FasaPay, QIWI, Payoneer,

Pepperstone Risk warning : CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89 % of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

🤴 XM is Used By: 10,000,000

⚡ XM is Regulated by: Financial Services Commission (FSC), Cyprus Securities and Exchange Commission (CySEC), Australian Securities and Investments Commission (ASIC)

💵 What You Can Trade with XM: Forex, Stock CFDs, Commodity CFDs, Minors, Majors, Exotics, Equity Indices CFD, Energies CFD, Precious Metals

💵 Instruments Available with XM: 1000

📈 XM Inactivity Fees: Yes

💰 XM Withdrawal Fees: No

💰 XM Payment Methods: Credit cards, Debit cards, Bank Transfer, Electronic wallets (eWallets), Moneta, ABAQOOS, PRZELEWY24, Neteller, PerfectMoney, WebMoney, UnionPay, FasaPay, CashU, Payza, QIWI, SOFORT, Giropay, Payoneer, Skrill,

XM Risk warning : CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor

accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford

to take the high risk of losing your money.

🤴 FXPrimus is Used By: 10,000

⚡ FXPrimus is Regulated by: Cyprus Securities and Exchange Commission (CySEC), Markets In Financial Instruments Directive (MiFID), Vanuatu Financial Services Commission (VFSC)

💵 What You Can Trade with FXPrimus: Forex, Minors, Majors, Exotics, Indices, UK Stocks, US Stocks, Energies, Metals,

💵 Instruments Available with FXPrimus: 130

📈 FXPrimus Inactivity Fees: No

💰 FXPrimus Withdrawal Fees: Varies

💰 FXPrimus Payment Methods: Credit cards, VISA, MasterCard, Debit cards, Bank Transfer, Electronic wallets (eWallets), Neteller, Skrill, Payoneer, SafeCharge, TrustPay, EmerchantPay, Bitcoin, UnionPay, FasaPay, Giropay,

FXPrimus Risk warning : Losses can exceed deposits

🤴 easyMarkets is Used By: 142,500

⚡ easyMarkets is Regulated by: Cyprus Securities and Exchange Commission (CySEC), Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA), British Virgin Islands Financial Services Commission (BVI)

💵 What You Can Trade with easyMarkets: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, Energies, Metals, Agriculturals, Options,

💵 Instruments Available with easyMarkets: 200

📈 easyMarkets Inactivity Fees: No

💰 easyMarkets Withdrawal Fees: No

💰 easyMarkets Payment Methods: Credit cards, MasterCard, Maestro, American Express, JCB, Astropay, Debit cards, Bank Transfer, SOFORT, GiroPay, iDeal, Bpay, Electronic wallets (eWallets), Skrill, Neteller, WebMoney, UnionPay, WeChatPay, FasaPay, STICPAY,

easyMarkets Risk warning : Your capital is at risk

🤴 Trading 212 is Used By: 15,000,000

⚡ Trading 212 is Regulated by: Financial Conduct Authority (FCA), Financial Supervision Commission (FSC)

💵 What You Can Trade with Trading 212: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, UK Stocks, US Stocks, Energies, Metals, ETFs, Bonds,

💵 Instruments Available with Trading 212: 10000

📈 Trading 212 Inactivity Fees: No

💰 Trading 212 Withdrawal Fees: No

💰 Trading 212 Payment Methods: Credit cards, MasterCard, VISA, Debit cards, Bank Transfer, Electronic wallets (eWallets), PayPal, Skrill, Dotpay, Carte Bleue, Direct eBanking, Apple Pay, Google Pay, iDeal, Giropay,

Trading 212 Risk warning : CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

🤴 SpreadEx is Used By: 10,000

⚡ SpreadEx is Regulated by: Financial Conduct Authority (FCA)

💵 What You Can Trade with SpreadEx: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, UK Stocks, US Stocks, Pennystocks, Energies, Metals, Agriculturals, ETFs, IPO, Bonds, Options, Treasuries,

💵 Instruments Available with SpreadEx: 15000

📈 SpreadEx Inactivity Fees: No

💰 SpreadEx Withdrawal Fees: 0, minimum £50

💰 SpreadEx Payment Methods: Credit cards, VISA, Switch, Maestro, Debit cards, Bank Transfer, Payoneer,

SpreadEx Risk warning : Losses can exceed deposits

🤴 Admiral Markets is Used By: 10,000

⚡ Admiral Markets is Regulated by: Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Australian Securities and Investments Commission (ASIC), Jordan Securities Commission (JSC)

💵 What You Can Trade with Admiral Markets: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, UK Stocks, US Stocks, Energies, Metals, ETFs, Bonds,

💵 Instruments Available with Admiral Markets: 148

📈 Admiral Markets Inactivity Fees: No

💰 Admiral Markets Withdrawal Fees: No

💰 Admiral Markets Payment Methods: Credit cards, Visa, MasterCard, Debit cards, Bank Transfer, Electronic wallets (eWallets), PayPal, Neteller, Skrill, SOFORT, Safety Pay, Przelewy, iDEAL, Klarna,

Admiral Markets Risk warning : Losses can exceed deposits

🤴 Markets.com is Used By: 4,000,000

⚡ Markets.com is Regulated by: Cyprus Securities and Exchange Commission (CySEC), Financial Sector Conduct Authority (FSCA), Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), BVI Financial Services Commission (BVI FSC)

💵 What You Can Trade with Markets.com: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, UK Stocks, US Stocks, Energies, Metals, Agriculturals, ETFs, Bonds,

💵 Instruments Available with Markets.com: 2200

📈 Markets.com Inactivity Fees: Yes

💰 Markets.com Withdrawal Fees: No

💰 Markets.com Payment Methods: Credit cards, Debit cards, Bank Transfer, Electronic wallets (eWallets), Skrill, Neteller, PayPal,

Markets.com Risk warning : 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

🤴 HYCM is Used By: 10,000

⚡ HYCM is Regulated by: Financial Conduct Authority (FCA), FCA reference number 186171, Cyprus Securities and Exchange Commission (CySEC), CySEC license number 259/14, Cayman Islands Monetary Authority (CIMA), CIMA reference number 1442313, Dubai financial services authority (DFSA), DFSA license number 000048

💵 What You Can Trade with HYCM: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, UK Stocks, Energies, Metals, Agriculturals,

💵 Instruments Available with HYCM: 100

📈 HYCM Inactivity Fees: Yes

💰 HYCM Withdrawal Fees: No

💰 HYCM Payment Methods: Credit cards, Debit cards, Bank Transfer, PayPal, WebMoney, Payoneer,

HYCM Risk warning : Losses can exceed deposits

🤴 Axi is Used By: 10,000

⚡ Axi is Regulated by: Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Dubai Financial Services Authority (DFSA), Financial Service Authority of St. Vincent and the Grenadines (FSA)

💵 What You Can Trade with Axi: Forex, Minors, Cryptocurrencies, Majors, Exotics,

💵 Instruments Available with Axi: 100

📈 Axi Inactivity Fees: No

💰 Axi Withdrawal Fees: No

💰 Axi Payment Methods: Credit cards, Debit cards, Bank Transfer, Neteller, BPAY, UnionPay, Payoneer,

Axi Risk warning : Losses can exceed deposits

🤴 ThinkMarkets is Used By: 500,000

⚡ ThinkMarkets is Regulated by: Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Financial Sector Conduct Authority (FSCA), Financial Services Authority Seychelles (FSA), TF Global Markets (UK) Limited is authorised and regulated by the Financial Conduct Authority FRN 629628, TF Global Markets (AUST) Limited is the holder of Australian Financial Services License number 424700, TF Global Markets (South Africa)(Pty) Ltd is an Authorised Financial Services Provider (FSP No 49835),TF Global Markets Int Limited Is authorised and regulated by the Financial Services Authority Firm Reference Number SD060

💵 What You Can Trade with ThinkMarkets: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, Energies, Metals,

💵 Instruments Available with ThinkMarkets: 1500

📈 ThinkMarkets Inactivity Fees: Yes

💰 ThinkMarkets Withdrawal Fees: No

💰 ThinkMarkets Payment Methods: Credit cards, Debit cards, Bank Transfer, Electronic wallets (eWallets), Neteller, Skrill, BitPay,

ThinkMarkets Risk warning : CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71.89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

🤴 Swissquote is Used By: 300,000

⚡ Swissquote is Regulated by: Swiss Financial Market Supervisory Authority (FINMA), Commission de Surveillance du Secteur Financier (CSSF), Financial Conduct Authority, Dubai Financial Services Authority (DFSA), Hong Kong Securities and Futures Commission (SFC), Monetary Authority of Singapore (MAS)

💵 What You Can Trade with Swissquote: Forex, Minors, Majors, Exotics, Indices, UK Stocks, US Stocks, Pennystocks, Energies, Metals, Bonds,

💵 Instruments Available with Swissquote: 100

📈 Swissquote Inactivity Fees: No

💰 Swissquote Withdrawal Fees: $10

💰 Swissquote Payment Methods: Credit cards, Debit cards, Bank Transfer, Payoneer,

Swissquote Risk warning : Losses can exceed deposits

🤴 ForexMart is Used By: 10,000

⚡ ForexMart is Regulated by: Cyprus Securities and Exchange Commission (CySEC)

💵 What You Can Trade with ForexMart: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, UK Stocks, US Stocks, Energies, Metals, ETFs, Bonds,

💵 Instruments Available with ForexMart: 111

📈 ForexMart Inactivity Fees: No

💰 ForexMart Withdrawal Fees: 5

💰 ForexMart Payment Methods: Bank Transfer, Visa, MasterCard, Skrill, Neteller, PayCo, fasaPay, Qiwi, Union Pay, AliPay,

ForexMart Risk warning : Your capital is at risk

🤴 ForTrade is Used By: 1,000,000

⚡ ForTrade is Regulated by: Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Investment Industry Regulatory Organization of Canada (IIROC), National Bank of the Republic of Belarus (NBRB)

💵 What You Can Trade with ForTrade: Forex, Minors, Cryptocurrencies, Majors, Exotics, Bonds,

💵 Instruments Available with ForTrade: 100

📈 ForTrade Inactivity Fees:

💰 ForTrade Withdrawal Fees: No

💰 ForTrade Payment Methods: Credit cards, Debit cards, Bank Transfer, PayPal, Neteller, Payoneer,

ForTrade Risk warning : Your capital is at risk

South Africa Copy trading is the practice of copying or mirroring an existing trader’s portfolio. The copied trader’s portfolio is usually selected from a list of top performing traders on the South Africa copy trading platform. In most cases, these are professional traders and financial analysts who are experts in their fields.

The idea behind copy trading for South African is that if you copy successful traders.

South Africa copy trades involves a South Africa person setting a budget and copying the portfolio of trades of a another trader, who has access to more information than they do, usually because they have access to more resources and have more experience.

The South Africa trader receiving the copied trade does not have any influence over the actual trading decision made by the other trader, other than supplying them with information about their order. South Africa traders are simply ‘copying’ or mimicking trades from someone else who has already decided to enter into a position in that market. It requires two people: one placing an order and another taking advantage of that order.

When using a South Africa copy trading platform, there are several ways to use Copy Trading: through the “Mirror Trader” functionality, social copy trading and using pre-made portfolios by industry experts.

You can also copy trade by copying the investments of other investors from within your South Africa social trading network. When using this option, you are able to follow certain South Africa copy trading platform users who you know and trust, or with whom you share similar investment objectives.

This is useful if there are specific traders or accounts that you want to closely follow and monitor their performance. The main advantage of this feature is that it allows for a more personal element to trading for South African copy traders – making it easier for you to develop trusting relationships with other traders on the platform.

Many South Africa copy trading platforms also provide pre-made portfolios created by industry experts in various sectors such as tech, energy and healthcare.

These portfolios have been designed by financial analysts who have years of experience in these fields and they provide an excellent starting point if for South African traders considering investing in certain markets but aren’t sure where to begin.

South Africa copy traders can easily copy trades from these pre-set portfolios which include detailed explanations of why the trades were made and how they relate to each market sector.

The first way for South Africa traders to copy trade is through copy trading platforms like “Mirror Trader” which uses algorithmic technology to match your investments with those made by other top investors on the platform.

It does this by comparing South African copy traders investment performance with those made by other investors in real time and then automatically investing amounts just like they have done.

For South Africa copy traders who require additional investment advice or analysis as part of your mirror trading experience, then it is possible for a human analyst to manually adjust your investment parameters for periods if required (for a fee).

You will also be able to double check the South Africa copy trading algorithms actions at any time and see detailed explanations regarding how each trade was calculated.

South Africa Mirror trader uses sophisticated technology developed in collaboration with academics from MIT and features complex algorithms that mimic the behaviour of experienced South Africa investors based on real market data provided by Thomson Reuters Eikon, one of the most powerful financial information providers in the world.

It makes trades 24 hours a day 7 days a week; always striving to produce profitable returns – even when markets close.

No. It is legal to copy trades of other traders in South Africa, but you should be aware that some brokers may restrict this practice for various reasons. Copying trading is not illegal. The only thing you should be aware of is that copying a trader's trades can never be 100% safe - there will always be unknown factors that may affect the outcome of any trade and as such, a copied trade may fail.

South Africa copy trading is legal. Copy trading is legal under EU law, but several countries have different regulations regarding copy-trading services so consult your local authority before signing up with one of these services. For example, France has made copy-trading unlawful while others such as Germany and Australia do not regulate this type of service.

South Africa social copy trading has several advantages over traditional copy trading sites – mainly that it allows users to avoid paying additional fees while still gaining access to valuable investment opportunities.

It also provides knowledge sharing opportunities for South Africa copy trading app traders, as well as support from seasoned investors on how they arrived at their decisions regarding which trades to make in the market.

Additionally, some South Africa social copy trade platforms allow users to find investors that match their own investing strategies and goals so they can share skills and knowledge more effectively by learning from each other's succesful trades and mistakes alike.

Instead of simply following instructions blindly provided by an impersonal algorithm that focuses solely on profit maximization with no regard for South African trader needs or preferences whatsoever.

Unfortunately, there are many fraudulent platforms operating today in this space so it always pays off for South African traders to conduct research into any potential website or platform before signing up for its services or sending them any money.

Especially when dealing with new South Africa sites or those whose reputations have yet not been established within the industry itself and throughout various communities where traders exchange information about various sites and platforms all day long every single day during business hours 24/7.

Copy trading is not a free service to South Africa traders. Copy trading companies have to pay for data search and the cost of operating their platforms. Therefore, it will be charged a small fee for using the service.

South Africa traders must also consider that the platform you choose may not offer all financial instruments or assets you are interested in trading. It is also important to note that although copy trading is designed to provide investment ideas, it does not guarantee those trades or profits.

Many South Africa social trading platforms offer copy trading services for a fee, which vary between copy trading brokers.

However, many South Africa traders do not have the money to pay for these extra features. Fortunately, there are other ways to utilize South Africa copy trading without having to pay for it directly.

One of the best options for South Africa copy trading app traders who cannot afford extra fees is social copy trading. This option involves joining a community of investors and copying their trades through the platform's internal software system without incurring any additional costs.

South Africa Copy trading can be profitable when used correctly but as with any investing strategy; there are no guarantees that your investments will be successful every time! In order best ensure a high level of profitability when using South Africa copy trading functionality it’s important to educate yourself on the subject matter relating to each asset class before copying any trader on the South Africa copy trading apps;

It’s also important for South African traders not to blindly follow every trade made by a top investor but instead use their portfolio as an opportunity explore new assets and learn about how different assets respond under different market conditions.

South Africa copy traders should never invest money that you cannot afford to lose when using this feature! There are significant risks involved whenever trading risky assets such as cryptocurrencies – always remember that if things go wrong you may lose capital.

If South Africa isn’t quite what you are looking for you can check out some of the best South Africa alternatives below.

If you would like to see South Africa compared against some of the best South Africa Copy Trading App alternatives available right now you can do so by clicking on the links below.