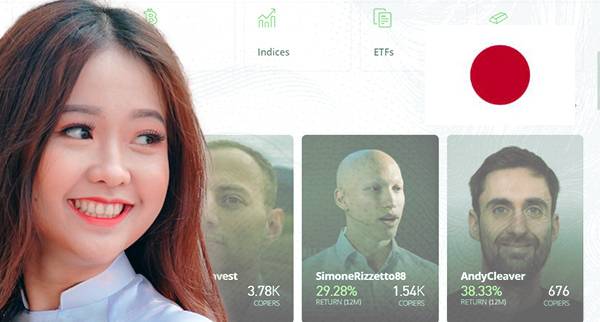

There are many websites offering copy-trading services to Japan traders. eToro is the worlds largest copy trading platform and offers more than 1 million users in over 140 countries including Japan. eToro is not the only copy trading platform out there we describe the best Japan copy trading platforms in more detail further below this guide. Japan copy trading platforms offer financial instruments across major asset classes including currency pairs traded on a range of major global exchanges around the world as well as indices and commodities.

Japan a platform where they can copy trade CFDs on currencies, commodities and indices via their social network which allows users to follow each other’s investment strategy and potentially profit from them.

Japan copy trading platforms offer daily market news updates from top financial publications like The Wall Street Journal an Forbes magazine among others through an online portal called MarketWatch which give traders access to vital information needed for making sound investment decisions about investments such as forex or stocks.

🤴 AvaTrade is Used By: 200,000

⚡ AvaTrade is Regulated by: Central Bank of Ireland, Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA), South African Financial Sector Conduct Authority (FSCA), Financial Stability Board (FSB), Abu Dhabi Global Markets (ADGM), Financial Regulatory Services Authority (FRSA), British Virgin Islands Financial Services Commission (BVI)

💵 What You Can Trade with AvaTrade: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, UK Stocks, US Stocks, Energies, Metals, Agriculturals, ETFs, IPO, Bonds,

💵 Instruments Available with AvaTrade: 1000

📈 AvaTrade Inactivity Fees: No

💰 AvaTrade Withdrawal Fees: No

💰 AvaTrade Payment Methods: Credit cards, VISA, MasterCard, Bank Transfer, Electronic wallets (eWallets), PayPal, Neteller, WebMoney, Payoneer,

AvaTrade Risk warning : 71% of retail CFD accounts lose money

🤴 NordFX is Used By: 10,000

⚡ NordFX is Regulated by: Cyprus Securities and Exchange Commission (CySEC), License No: 209/13

💵 What You Can Trade with NordFX: Forex, Majors, Metals,

💵 Instruments Available with NordFX: 50

📈 NordFX Inactivity Fees: No

💰 NordFX Withdrawal Fees: No

💰 NordFX Payment Methods: Bank Transfer, Neteller, PerfectMoney, WebMoney, FasaPay, CashU, Payza, QIWI,

NordFX Risk warning : Losses can exceed deposits

🤴 XTB is Used By: 250,000

⚡ XTB is Regulated by: Financial Conduct Authority (FCA), FCA number FRN 522157, Cyprus Securities and Exchange Commission (CySEC), CySEC Licence Number: 169/12, Comision Nacional del Mercado de Valores, Komisja Nadzoru Finansowego, Belize International Financial Services Commission (IFSC) under license number IFSC/60/413/TS/19, Polish Securities and Exchange Commission (KPWiG), Dubai Financial Services Authority (DFSA), Dubai International Financial Center (DIFC),Financial Sector Conduct Authority (FSCA), XTB AFRICA (PTY) LTD licensed to operate in South Africa

💵 What You Can Trade with XTB: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, UK Stocks, US Stocks, Pennystocks, Energies, Metals, Agriculturals, ETFs,

💵 Instruments Available with XTB: 4000

📈 XTB Inactivity Fees: Yes

💰 XTB Withdrawal Fees: No

💰 XTB Payment Methods: Credit cards, MasterCard, Maestro, Visa, Debit cards, Bank Transfer, Electronic wallets (eWallets), PayPal, Neteller, Skrill, Poli, Paysafe, Payoneer,

XTB Risk warning : 76% - 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

🤴 XM is Used By: 10,000,000

⚡ XM is Regulated by: Financial Services Commission (FSC), Cyprus Securities and Exchange Commission (CySEC), Australian Securities and Investments Commission (ASIC)

💵 What You Can Trade with XM: Forex, Stock CFDs, Commodity CFDs, Minors, Majors, Exotics, Equity Indices CFD, Energies CFD, Precious Metals

💵 Instruments Available with XM: 1000

📈 XM Inactivity Fees: Yes

💰 XM Withdrawal Fees: No

💰 XM Payment Methods: Credit cards, Debit cards, Bank Transfer, Electronic wallets (eWallets), Moneta, ABAQOOS, PRZELEWY24, Neteller, PerfectMoney, WebMoney, UnionPay, FasaPay, CashU, Payza, QIWI, SOFORT, Giropay, Payoneer, Skrill,

XM Risk warning : CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.74% of retail investor

accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford

to take the high risk of losing your money.

🤴 easyMarkets is Used By: 142,500

⚡ easyMarkets is Regulated by: Cyprus Securities and Exchange Commission (CySEC), Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA), British Virgin Islands Financial Services Commission (BVI)

💵 What You Can Trade with easyMarkets: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, Energies, Metals, Agriculturals, Options,

💵 Instruments Available with easyMarkets: 200

📈 easyMarkets Inactivity Fees: No

💰 easyMarkets Withdrawal Fees: No

💰 easyMarkets Payment Methods: Credit cards, MasterCard, Maestro, American Express, JCB, Astropay, Debit cards, Bank Transfer, SOFORT, GiroPay, iDeal, Bpay, Electronic wallets (eWallets), Skrill, Neteller, WebMoney, UnionPay, WeChatPay, FasaPay, STICPAY,

easyMarkets Risk warning : Your capital is at risk

🤴 Trading 212 is Used By: 15,000,000

⚡ Trading 212 is Regulated by: Financial Conduct Authority (FCA), Financial Supervision Commission (FSC)

💵 What You Can Trade with Trading 212: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, UK Stocks, US Stocks, Energies, Metals, ETFs, Bonds,

💵 Instruments Available with Trading 212: 10000

📈 Trading 212 Inactivity Fees: No

💰 Trading 212 Withdrawal Fees: No

💰 Trading 212 Payment Methods: Credit cards, MasterCard, VISA, Debit cards, Bank Transfer, Electronic wallets (eWallets), PayPal, Skrill, Dotpay, Carte Bleue, Direct eBanking, Apple Pay, Google Pay, iDeal, Giropay,

Trading 212 Risk warning : CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

🤴 SpreadEx is Used By: 10,000

⚡ SpreadEx is Regulated by: Financial Conduct Authority (FCA)

💵 What You Can Trade with SpreadEx: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, UK Stocks, US Stocks, Pennystocks, Energies, Metals, Agriculturals, ETFs, IPO, Bonds, Options, Treasuries,

💵 Instruments Available with SpreadEx: 15000

📈 SpreadEx Inactivity Fees: No

💰 SpreadEx Withdrawal Fees: 0, minimum £50

💰 SpreadEx Payment Methods: Credit cards, VISA, Switch, Maestro, Debit cards, Bank Transfer, Payoneer,

SpreadEx Risk warning : Losses can exceed deposits

🤴 HYCM is Used By: 10,000

⚡ HYCM is Regulated by: Financial Conduct Authority (FCA), FCA reference number 186171, Cyprus Securities and Exchange Commission (CySEC), CySEC license number 259/14, Cayman Islands Monetary Authority (CIMA), CIMA reference number 1442313, Dubai financial services authority (DFSA), DFSA license number 000048

💵 What You Can Trade with HYCM: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, UK Stocks, Energies, Metals, Agriculturals,

💵 Instruments Available with HYCM: 100

📈 HYCM Inactivity Fees: Yes

💰 HYCM Withdrawal Fees: No

💰 HYCM Payment Methods: Credit cards, Debit cards, Bank Transfer, PayPal, WebMoney, Payoneer,

HYCM Risk warning : Losses can exceed deposits

🤴 Swissquote is Used By: 300,000

⚡ Swissquote is Regulated by: Swiss Financial Market Supervisory Authority (FINMA), Commission de Surveillance du Secteur Financier (CSSF), Financial Conduct Authority, Dubai Financial Services Authority (DFSA), Hong Kong Securities and Futures Commission (SFC), Monetary Authority of Singapore (MAS)

💵 What You Can Trade with Swissquote: Forex, Minors, Majors, Exotics, Indices, UK Stocks, US Stocks, Pennystocks, Energies, Metals, Bonds,

💵 Instruments Available with Swissquote: 100

📈 Swissquote Inactivity Fees: No

💰 Swissquote Withdrawal Fees: $10

💰 Swissquote Payment Methods: Credit cards, Debit cards, Bank Transfer, Payoneer,

Swissquote Risk warning : Losses can exceed deposits

🤴 ForexMart is Used By: 10,000

⚡ ForexMart is Regulated by: Cyprus Securities and Exchange Commission (CySEC)

💵 What You Can Trade with ForexMart: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, UK Stocks, US Stocks, Energies, Metals, ETFs, Bonds,

💵 Instruments Available with ForexMart: 111

📈 ForexMart Inactivity Fees: No

💰 ForexMart Withdrawal Fees: 5

💰 ForexMart Payment Methods: Bank Transfer, Visa, MasterCard, Skrill, Neteller, PayCo, fasaPay, Qiwi, Union Pay, AliPay,

ForexMart Risk warning : Your capital is at risk

🤴 ForTrade is Used By: 1,000,000

⚡ ForTrade is Regulated by: Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Investment Industry Regulatory Organization of Canada (IIROC), National Bank of the Republic of Belarus (NBRB)

💵 What You Can Trade with ForTrade: Forex, Minors, Cryptocurrencies, Majors, Exotics, Bonds,

💵 Instruments Available with ForTrade: 100

📈 ForTrade Inactivity Fees:

💰 ForTrade Withdrawal Fees: No

💰 ForTrade Payment Methods: Credit cards, Debit cards, Bank Transfer, PayPal, Neteller, Payoneer,

ForTrade Risk warning : Your capital is at risk

🤴 FxPro is Used By: 1,866,000

⚡ FxPro is Regulated by: Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Financial Sector Conduct Authority (FSCA), Securities Commission of the Bahamas (SCB)

💵 What You Can Trade with FxPro: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, UK Stocks, US Stocks, Energies, Metals, Agriculturals,

💵 Instruments Available with FxPro: 430

📈 FxPro Inactivity Fees: Yes

💰 FxPro Withdrawal Fees: No

💰 FxPro Payment Methods: Bank, Wire Transfers, Credit cards, Debit Cards, Visa, Maestro, MasterCard, American Express, eWallets, PayPal, Skrill, Neteller, UnionPay

FxPro Risk warning : 75.78% of retail investor accounts lose money when trading CFDs and Spread Betting with this provider

🤴 Eightcap is Used By: 10,000

⚡ Eightcap is Regulated by: Australian Securities and Investments Commission (ASIC), Vanuatu Financial Services Commission (VFSC)

💵 What You Can Trade with Eightcap: Forex, Minors, Majors, Exotics, Indices, Energies, Metals,

💵 Instruments Available with Eightcap: 100

📈 Eightcap Inactivity Fees: No

💰 Eightcap Withdrawal Fees: Yes

💰 Eightcap Payment Methods: Credit cards, Debit cards, Bank Transfer, POLi, UnionPay, Payoneer,

Eightcap Risk warning : Losses can exceed deposits

🤴 ETFinance is Used By: 10,000

⚡ ETFinance is Regulated by: Cyprus Securities and Exchange Commission (CySEC)

💵 What You Can Trade with ETFinance: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, UK Stocks, US Stocks, Energies, Metals, ETFs, Bonds,

💵 Instruments Available with ETFinance: 150

📈 ETFinance Inactivity Fees:

💰 ETFinance Withdrawal Fees: $100/10000JPY

💰 ETFinance Payment Methods: Bank Bank Wire transfer, Electronic wallets (eWallets), Skrill account, Neteller,

ETFinance Risk warning : Trading leverage products may not be suitable for all traders. 71% of retail CFD accounts lose money.

🤴 Interactive Brokers is Used By: 10,000

⚡ Interactive Brokers is Regulated by: Financial Conduct Authority (FCA)

💵 What You Can Trade with Interactive Brokers: Forex, Majors, Indices, UK Stocks, UK Stocks, Energies, Metals, Agriculturals, ETFs,

💵 Instruments Available with Interactive Brokers: 100

📈 Interactive Brokers Inactivity Fees: Yes

💰 Interactive Brokers Withdrawal Fees: 10 USD

💰 Interactive Brokers Payment Methods: Bank Transfer, American Express, Cheque or Check,

Interactive Brokers Risk warning : Losses can exceed deposits

🤴 IG is Used By: 239,000

⚡ IG is Regulated by: Financial Conduct Authority (FCA), Federal Financial Supervisory Authority (BaFin), Swiss Financial Markets Supervisory Authority (FINMA), Commodity Futures Trading Commission (CFTC), National Futures Association (NFA), Australian Securities and Investment Commission (ASIC), Financial Markets Authority (FMA), Monetary Authority of Singapore (MAS), Japanese Financial Services Authority (FSA), Financial Sector Conduct Authority (FSCA), Dubai Financial Services Authority (DFSA), Bermuda Monetary Authority (BMA)

💵 What You Can Trade with IG: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, UK Stocks, US Stocks, Energies, Metals, Agriculturals, ETFs, IPO, Bonds, Options,

💵 Instruments Available with IG: 17000

📈 IG Inactivity Fees: Yes

💰 IG Withdrawal Fees: No

💰 IG Payment Methods: Credit cards, VISA, MasterCard, Debit cards, Bank Transfer, Electronic wallets (eWallets), PayPal, BPAY, Payoneer,

IG Risk warning : 70% of retail CFD accounts lose money

🤴 GKFX is Used By: 10,000

⚡ GKFX is Regulated by: Malta Financial Services Authority (MFSA)

💵 What You Can Trade with GKFX: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, US Stocks, UK Stocks, Energies, Metals, Agriculturals,

💵 Instruments Available with GKFX: 100

📈 GKFX Inactivity Fees: No

💰 GKFX Withdrawal Fees: No

💰 GKFX Payment Methods: Credit cards, Debit cards, Bank Transfer, SOFORT, Payoneer,

GKFX Risk warning : Losses can exceed deposits

🤴 Oanda is Used By: 10,000

⚡ Oanda is Regulated by: Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC)

💵 What You Can Trade with Oanda: Forex, Minors, Majors, Exotics, Indices, Energies, Metals, Agriculturals, Bonds,

💵 Instruments Available with Oanda: 100

📈 Oanda Inactivity Fees: No

💰 Oanda Withdrawal Fees: No

💰 Oanda Payment Methods: Bank Transfer, Cheque or Check, Debit cards, Payoneer,

Oanda Risk warning : 74-89% of retail CFD accounts lose money

🤴 Core Spreads is Used By: 10,000

⚡ Core Spreads is Regulated by: Financial Conduct Authority (FCA)

💵 What You Can Trade with Core Spreads: Forex, Minors, Majors, Exotics, Indices, UK Stocks, UK Stocks, Energies, Metals,

💵 Instruments Available with Core Spreads: 1605

📈 Core Spreads Inactivity Fees: No

💰 Core Spreads Withdrawal Fees: No

💰 Core Spreads Payment Methods: Credit cards, Bank Transfer, Skrill, Payoneer,

Core Spreads Risk warning : Losses can exceed deposits

🤴 UFX is Used By: 10,000

⚡ UFX is Regulated by: Cyprus Securities and Exchange Commission (CySEC)

💵 What You Can Trade with UFX: Forex, Minors, Cryptocurrencies, Majors, Exotics, Indices, UK Stocks, US Stocks, Energies, Metals, Agriculturals, ETFs,

💵 Instruments Available with UFX: 100

📈 UFX Inactivity Fees: Yes

💰 UFX Withdrawal Fees: No

💰 UFX Payment Methods: Credit cards, Bank Transfer, American Express, Neteller, Bitcoin, WebMoney, POLi, UnionPay, CashU, QIWI, SOFORT, Giropay, Payoneer,

UFX Risk warning : Your capital is at risk

Japan Copy trading is the practice of copying or mirroring an existing trader’s portfolio. The copied trader’s portfolio is usually selected from a list of top performing traders on the Japan copy trading platform. In most cases, these are professional traders and financial analysts who are experts in their fields.

The idea behind copy trading for Japanese is that if you copy successful traders.

Japan copy trades involves a Japan person setting a budget and copying the portfolio of trades of a another trader, who has access to more information than they do, usually because they have access to more resources and have more experience.

The Japan trader receiving the copied trade does not have any influence over the actual trading decision made by the other trader, other than supplying them with information about their order. Japan traders are simply ‘copying’ or mimicking trades from someone else who has already decided to enter into a position in that market. It requires two people: one placing an order and another taking advantage of that order.

When using a Japan copy trading platform, there are several ways to use Copy Trading: through the “Mirror Trader” functionality, social copy trading and using pre-made portfolios by industry experts.

You can also copy trade by copying the investments of other investors from within your Japan social trading network. When using this option, you are able to follow certain Japan copy trading platform users who you know and trust, or with whom you share similar investment objectives.

This is useful if there are specific traders or accounts that you want to closely follow and monitor their performance. The main advantage of this feature is that it allows for a more personal element to trading for Japanese copy traders – making it easier for you to develop trusting relationships with other traders on the platform.

Many Japan copy trading platforms also provide pre-made portfolios created by industry experts in various sectors such as tech, energy and healthcare.

These portfolios have been designed by financial analysts who have years of experience in these fields and they provide an excellent starting point if for Japanese traders considering investing in certain markets but aren’t sure where to begin.

Japan copy traders can easily copy trades from these pre-set portfolios which include detailed explanations of why the trades were made and how they relate to each market sector.

The first way for Japan traders to copy trade is through copy trading platforms like “Mirror Trader” which uses algorithmic technology to match your investments with those made by other top investors on the platform.

It does this by comparing Japanese copy traders investment performance with those made by other investors in real time and then automatically investing amounts just like they have done.

For Japan copy traders who require additional investment advice or analysis as part of your mirror trading experience, then it is possible for a human analyst to manually adjust your investment parameters for periods if required (for a fee).

You will also be able to double check the Japan copy trading algorithms actions at any time and see detailed explanations regarding how each trade was calculated.

Japan Mirror trader uses sophisticated technology developed in collaboration with academics from MIT and features complex algorithms that mimic the behaviour of experienced Japan investors based on real market data provided by Thomson Reuters Eikon, one of the most powerful financial information providers in the world.

It makes trades 24 hours a day 7 days a week; always striving to produce profitable returns – even when markets close.

No. It is legal to copy trades of other traders in Japan, but you should be aware that some brokers may restrict this practice for various reasons. Copying trading is not illegal. The only thing you should be aware of is that copying a trader's trades can never be 100% safe - there will always be unknown factors that may affect the outcome of any trade and as such, a copied trade may fail.

Japan copy trading is legal. Copy trading is legal under EU law, but several countries have different regulations regarding copy-trading services so consult your local authority before signing up with one of these services. For example, France has made copy-trading unlawful while others such as Germany and Australia do not regulate this type of service.

Japan social copy trading has several advantages over traditional copy trading sites – mainly that it allows users to avoid paying additional fees while still gaining access to valuable investment opportunities.

It also provides knowledge sharing opportunities for Japan copy trading app traders, as well as support from seasoned investors on how they arrived at their decisions regarding which trades to make in the market.

Additionally, some Japan social copy trade platforms allow users to find investors that match their own investing strategies and goals so they can share skills and knowledge more effectively by learning from each other's succesful trades and mistakes alike.

Instead of simply following instructions blindly provided by an impersonal algorithm that focuses solely on profit maximization with no regard for Japanese trader needs or preferences whatsoever.

Unfortunately, there are many fraudulent platforms operating today in this space so it always pays off for Japanese traders to conduct research into any potential website or platform before signing up for its services or sending them any money.

Especially when dealing with new Japan sites or those whose reputations have yet not been established within the industry itself and throughout various communities where traders exchange information about various sites and platforms all day long every single day during business hours 24/7.

Copy trading is not a free service to Japan traders. Copy trading companies have to pay for data search and the cost of operating their platforms. Therefore, it will be charged a small fee for using the service.

Japan traders must also consider that the platform you choose may not offer all financial instruments or assets you are interested in trading. It is also important to note that although copy trading is designed to provide investment ideas, it does not guarantee those trades or profits.

Many Japan social trading platforms offer copy trading services for a fee, which vary between copy trading brokers.

However, many Japan traders do not have the money to pay for these extra features. Fortunately, there are other ways to utilize Japan copy trading without having to pay for it directly.

One of the best options for Japan copy trading app traders who cannot afford extra fees is social copy trading. This option involves joining a community of investors and copying their trades through the platform's internal software system without incurring any additional costs.

Japan Copy trading can be profitable when used correctly but as with any investing strategy; there are no guarantees that your investments will be successful every time! In order best ensure a high level of profitability when using Japan copy trading functionality it’s important to educate yourself on the subject matter relating to each asset class before copying any trader on the Japan copy trading apps;

It’s also important for Japanese traders not to blindly follow every trade made by a top investor but instead use their portfolio as an opportunity explore new assets and learn about how different assets respond under different market conditions.

Japan copy traders should never invest money that you cannot afford to lose when using this feature! There are significant risks involved whenever trading risky assets such as cryptocurrencies – always remember that if things go wrong you may lose capital.

If Japan isn’t quite what you are looking for you can check out some of the best Japan alternatives below.

If you would like to see Japan compared against some of the best Japan Copy Trading App alternatives available right now you can do so by clicking on the links below.